In the ever-evolving landscape of finance, predictive modeling has emerged as a crucial tool for decision-making and strategy formulation. As you navigate through the complexities of financial markets, understanding how predictive modeling works can significantly enhance your ability to forecast trends and make informed decisions. Predictive modeling involves using statistical techniques and algorithms to analyze historical data and predict future outcomes.

This process is not just about crunching numbers; it’s about uncovering patterns and insights that can guide your financial strategies. The importance of predictive modeling in finance cannot be overstated. It plays a pivotal role in risk management, portfolio optimization, and even fraud detection.

By leveraging historical data, you can identify potential risks and opportunities, allowing you to make proactive decisions rather than reactive ones. As you delve deeper into this field, you will discover that the integration of advanced techniques, such as machine learning, is revolutionizing how financial professionals approach predictive modeling. This article will guide you through the fundamental concepts of predictive modeling, focusing on linear regression and machine learning techniques, while also addressing best practices for building robust models.

Key Takeaways

- Predictive modeling is a powerful tool in finance for forecasting and decision-making.

- Linear regression is a commonly used technique in finance for predicting numerical values.

- Linear regression offers simplicity and interpretability but has limitations in capturing complex relationships.

- Machine learning techniques like decision trees and neural networks offer more flexibility and accuracy in financial modeling.

- Incorporating external factors and big data can enhance the accuracy and robustness of predictive models in finance.

Understanding Linear Regression and its Application in Finance

Linear regression is one of the most widely used statistical methods in predictive modeling, particularly in finance. At its core, linear regression seeks to establish a relationship between a dependent variable and one or more independent variables. For instance, if you are interested in predicting stock prices, you might use factors such as earnings reports, market trends, and economic indicators as independent variables.

The beauty of linear regression lies in its simplicity; it provides a clear equation that describes how changes in the independent variables affect the dependent variable. In finance, linear regression can be applied in various scenarios, from estimating the expected return on an investment to assessing the impact of interest rates on bond prices. By fitting a line to historical data points, you can visualize trends and make predictions about future performance.

However, while linear regression is a powerful tool, it is essential to recognize its limitations. The assumption of a linear relationship may not always hold true in complex financial markets, where relationships can be non-linear or influenced by multiple factors simultaneously.

The Advantages and Limitations of Linear Regression in Financial Modeling

One of the primary advantages of linear regression is its interpretability. As you work with this model, you will find that it provides clear insights into how each independent variable influences the dependent variable. This transparency is particularly valuable in finance, where stakeholders often require explanations for predictions and decisions.

Additionally, linear regression is relatively easy to implement and computationally efficient, making it accessible for professionals at various levels of expertise. However, despite its advantages, linear regression has notable limitations that you must consider. One significant drawback is its sensitivity to outliers, which can skew results and lead to misleading conclusions.

Furthermore, linear regression assumes that relationships between variables are constant over time, which may not be the case in dynamic financial environments. As you explore more complex financial scenarios, you may find that linear regression fails to capture the intricacies of market behavior, prompting you to seek alternative modeling techniques.

Exploring Machine Learning Techniques for Predictive Modeling in Finance

As you venture into the realm of predictive modeling, machine learning techniques offer a wealth of opportunities to enhance your forecasting capabilities. Unlike traditional statistical methods, machine learning algorithms can automatically learn from data patterns without being explicitly programmed. This adaptability makes them particularly suited for the unpredictable nature of financial markets.

Techniques such as decision trees, random forests, and neural networks are gaining traction among finance professionals seeking to improve their predictive accuracy. Machine learning excels in handling large datasets and identifying complex relationships that may be overlooked by simpler models like linear regression. For instance, when analyzing stock market trends, machine learning algorithms can process vast amounts of historical data and incorporate various factors simultaneously.

This capability allows you to uncover hidden patterns and correlations that traditional methods might miss. As you explore these advanced techniques, you will find that they can significantly enhance your ability to predict market movements and make data-driven decisions.

Building Future-Proof Predictive Models with Machine Learning Algorithms

To build future-proof predictive models using machine learning algorithms, it is essential to adopt a systematic approach. Start by defining your objectives clearly; whether you’re aiming to predict stock prices or assess credit risk, having a well-defined goal will guide your modeling process. Next, focus on data collection and preprocessing.

High-quality data is the foundation of any successful predictive model. Ensure that your dataset is clean, relevant, and representative of the problem you are trying to solve. Once your data is ready, you can begin selecting appropriate machine learning algorithms for your model.

Experimenting with different algorithms will help you identify which ones yield the best results for your specific application. Additionally, consider implementing techniques such as cross-validation to assess model performance and avoid overfitting. As you refine your models, remember that continuous monitoring and updating are crucial for maintaining their accuracy over time.

The financial landscape is constantly changing; therefore, your models must adapt to new information and trends to remain effective.

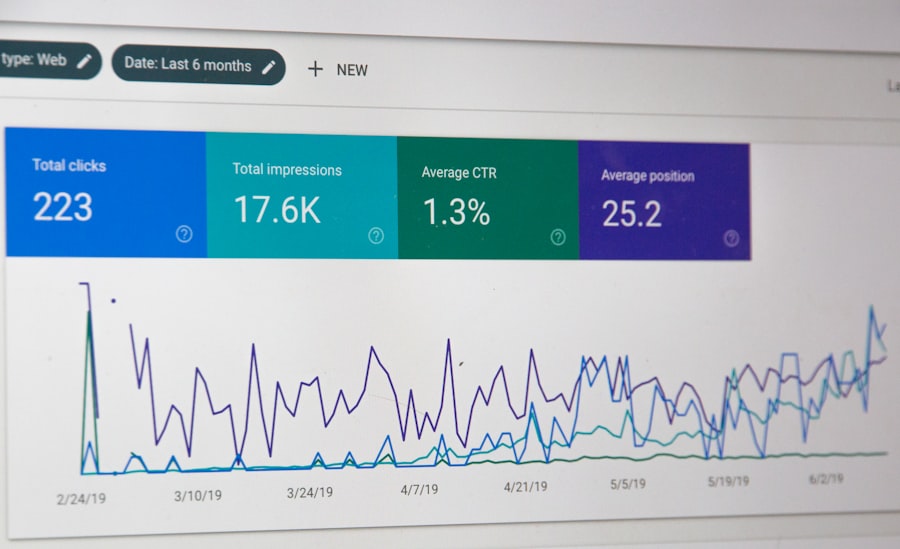

Evaluating the Performance of Predictive Models in Finance

Evaluating the performance of your predictive models is a critical step in ensuring their reliability and effectiveness. Various metrics can help you assess how well your model performs against actual outcomes. Common evaluation metrics include mean absolute error (MAE), root mean square error (RMSE), and R-squared values.

By analyzing these metrics, you can gain insights into your model’s accuracy and identify areas for improvement. In addition to quantitative metrics, qualitative assessments are equally important. Consider conducting backtesting by applying your model to historical data to see how well it would have performed in real-world scenarios.

This process allows you to validate your model’s predictions against actual market movements and adjust your approach accordingly. As you evaluate your models, keep in mind that no single metric can provide a complete picture; a combination of quantitative and qualitative assessments will give you a more comprehensive understanding of your model’s performance.

Incorporating External Factors and Big Data in Predictive Modeling

In today’s data-driven world, incorporating external factors and big data into your predictive modeling efforts can significantly enhance your forecasting capabilities. Financial markets are influenced by a myriad of factors beyond historical price movements; economic indicators, geopolitical events, and social media sentiment can all play a role in shaping market behavior. By integrating these external factors into your models, you can create a more holistic view of the market landscape.

Big data technologies enable you to process vast amounts of information from diverse sources quickly. For instance, sentiment analysis tools can analyze social media posts or news articles to gauge public sentiment about specific stocks or market conditions. By combining traditional financial data with insights derived from big data analytics, you can develop more robust predictive models that account for a wider range of influences on market behavior.

Best Practices for Building and Maintaining Future-Proof Predictive Models in Finance

To ensure that your predictive models remain effective over time, it is essential to adhere to best practices throughout the modeling process. First and foremost, prioritize data quality by regularly cleaning and updating your datasets. Inaccurate or outdated data can lead to flawed predictions and misguided decisions.

Additionally, maintain transparency in your modeling process; document your methodologies and assumptions so that stakeholders can understand how predictions are generated. Another best practice is to foster a culture of continuous learning within your organization. Encourage collaboration among team members with diverse skill sets to share insights and improve modeling techniques collectively.

Regularly revisit and refine your models based on new data and changing market conditions; this iterative approach will help ensure that your models remain relevant and accurate over time. In conclusion, predictive modeling is an invaluable tool in finance that empowers professionals like yourself to make informed decisions based on data-driven insights. By understanding the fundamentals of linear regression and exploring advanced machine learning techniques, you can build robust predictive models that adapt to the dynamic nature of financial markets.

Incorporating external factors and big data further enhances your forecasting capabilities while adhering to best practices ensures the longevity and effectiveness of your models. As you continue on this journey, remember that the key to success lies in embracing innovation while remaining grounded in sound analytical principles.