Commercial credit plays a crucial role in accounts receivable management for businesses of all sizes. When a company extends credit to customers, it allows them to purchase goods or services with a promise of future payment. This practice directly impacts the accounts receivable process by affecting the timing and amount of cash flow into the business.

Effective management of commercial credit is essential for maintaining healthy cash flow and ensuring sufficient working capital for smooth business operations. One significant impact of commercial credit on accounts receivable management is the potential for delayed payments. When customers are given credit terms, they may take longer to pay their invoices, leading to an increase in outstanding accounts receivable.

This can affect a company’s ability to meet its own financial obligations and invest in growth opportunities. Managing commercial credit requires careful assessment of customer creditworthiness to minimize the risk of non-payment or bad debt. This involves conducting thorough credit checks and setting appropriate credit limits to mitigate the impact on accounts receivable.

Commercial credit influences the cash flow and financial stability of a business. By allowing customers to defer payment for goods or services received, companies may experience an increase in outstanding accounts receivable and potential delays in cash inflow. Effective management of commercial credit is crucial for maintaining healthy cash flow and ensuring sufficient working capital for business operations.

The process involves careful assessment of customer creditworthiness, including thorough credit checks and setting appropriate credit limits, to minimize the risk of non-payment or bad debt. Overall, commercial credit has a direct impact on the efficiency and effectiveness of accounts receivable management. It is essential for businesses to implement robust credit policies and procedures to manage this aspect of their financial operations effectively.

Key Takeaways

- Commercial credit can have a significant impact on accounts receivable management, affecting cash flow and overall financial health.

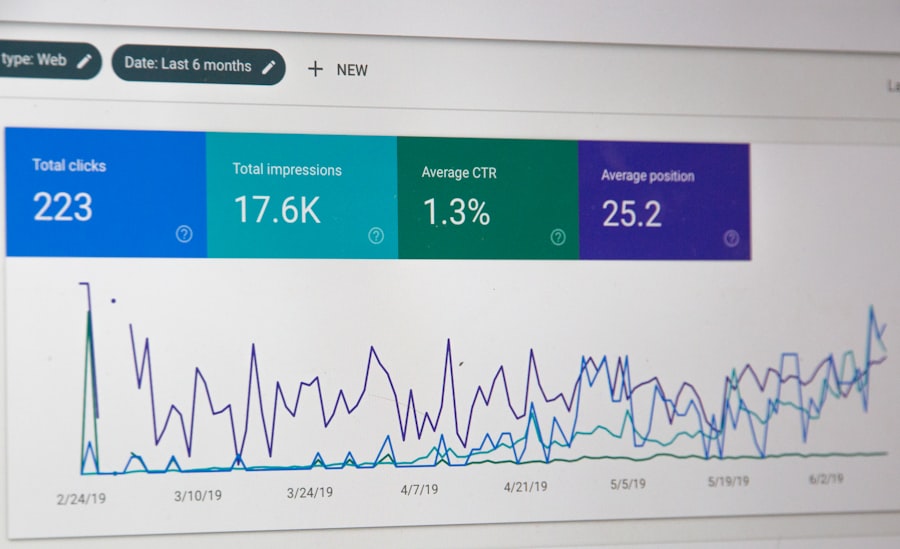

- Big data can be leveraged to optimize accounts receivable processes, providing insights into customer behavior and payment patterns.

- Artificial intelligence plays a crucial role in streamlining accounts receivable by automating repetitive tasks and identifying trends and anomalies in payment data.

- Data science can be harnessed to improve accounts receivable performance through predictive modeling and risk assessment.

- Applied analytics can empower accounts receivable management by providing actionable insights and identifying areas for improvement in the collection process.

Leveraging Big Data to Optimize Accounts Receivable Processes

Predictive Analytics for Improved Cash Flow Management

One way in which big data can optimize accounts receivable processes is through predictive analytics. By analyzing historical payment data and customer behavior patterns, businesses can identify trends and predict future payment behavior. This can help businesses anticipate cash flow fluctuations and take proactive measures to manage accounts receivable more effectively.

Customer Segmentation for Targeted Collection Strategies

Additionally, big data can be used to segment customers based on their payment behavior and credit risk, allowing businesses to tailor their collection strategies and credit terms accordingly. This can help businesses prioritize collection efforts and minimize the risk of bad debt.

Automation and Efficiency through Big Data Analytics

By leveraging big data analytics and machine learning algorithms, businesses can automate routine tasks such as invoice processing, payment matching, and dunning processes. This can help streamline accounts receivable operations, reduce manual errors, and improve overall efficiency. Additionally, big data can be used to identify opportunities for process improvement and cost reduction within the accounts receivable function, leading to greater operational efficiency and cost savings.

The Role of Artificial Intelligence in Streamlining Accounts Receivable

Artificial intelligence (AI) is playing an increasingly important role in streamlining accounts receivable processes for businesses. AI refers to the simulation of human intelligence in machines that are programmed to think and learn like humans. In the context of accounts receivable management, AI can be used to automate repetitive tasks, analyze large volumes of data, and make intelligent decisions based on complex algorithms.

One way in which AI is streamlining accounts receivable is through automated invoice processing. AI-powered systems can extract relevant information from invoices, such as due dates, payment terms, and invoice numbers, and automatically update the accounts receivable system. This can help businesses reduce manual errors, improve accuracy, and accelerate the invoice-to-cash cycle.

Additionally, AI can be used to automate payment matching processes by reconciling incoming payments with outstanding invoices, reducing the need for manual intervention and speeding up the cash application process. Another way in which AI is streamlining accounts receivable is through predictive analytics and decision-making. AI-powered algorithms can analyze historical payment data, customer behavior patterns, and credit risk factors to predict future payment behavior and identify potential delinquencies.

This can help businesses prioritize collection efforts, tailor credit terms, and minimize the risk of bad debt. Additionally, AI can be used to make intelligent decisions about when to send payment reminders, escalate collection efforts, or offer early payment discounts based on individual customer profiles.

Harnessing Data Science for Improved Accounts Receivable Performance

Data science is playing a crucial role in improving accounts receivable performance for businesses. Data science refers to the process of extracting insights and knowledge from structured and unstructured data using scientific methods, algorithms, and systems. By harnessing data science techniques, businesses can gain valuable insights into customer behavior, payment patterns, and credit risk, which can be used to optimize accounts receivable processes.

One way in which data science is improving accounts receivable performance is through advanced analytics and modeling. By analyzing historical payment data and customer behavior patterns, businesses can identify trends, correlations, and predictive indicators that can be used to optimize collection strategies and credit terms. This can help businesses anticipate cash flow fluctuations, reduce days sales outstanding (DSO), and minimize the risk of bad debt.

Another way in which data science is improving accounts receivable performance is through anomaly detection and fraud prevention. Data science techniques such as machine learning algorithms can be used to detect unusual payment patterns, identify potential fraud risks, and flag suspicious activities for further investigation. This can help businesses mitigate the risk of fraudulent transactions and improve overall accounts receivable security.

The Power of Applied Analytics in Accounts Receivable Management

Applied analytics is a powerful tool for businesses looking to improve their accounts receivable management processes. Applied analytics involves using statistical analysis and predictive modeling techniques to gain insights into customer behavior, payment patterns, and credit risk. By applying analytics to accounts receivable data, businesses can optimize collection strategies, tailor credit terms, and improve overall cash flow management.

One way in which applied analytics can improve accounts receivable management is through segmentation and targeting. By analyzing historical payment data and customer behavior patterns, businesses can segment customers based on their payment behavior and credit risk profiles. This allows businesses to tailor their collection strategies and credit terms according to individual customer needs, improving the effectiveness of accounts receivable management.

Another way in which applied analytics can improve accounts receivable management is through performance measurement and optimization. By analyzing key performance indicators such as days sales outstanding (DSO), aging reports, and collection effectiveness ratios, businesses can gain insights into the efficiency and effectiveness of their accounts receivable processes. This allows businesses to identify areas for improvement, set performance targets, and measure progress over time.

Integrating Technology for Enhanced Cash Flow and Accounts Receivable Efficiency

Automated Invoicing and Payment Processing

One way in which technology integration enhances cash flow is through automated invoicing and payment processing. By integrating ERP systems with accounts receivable automation platforms, businesses can automate routine tasks such as invoice generation, delivery, and payment processing. This can help accelerate the invoice-to-cash cycle, reduce billing errors, and improve overall cash flow management.

Seamless Data Exchange and Integration

Another way in which technology integration improves accounts receivable efficiency is through seamless data exchange and integration. By integrating CRM systems with accounts receivable platforms, businesses can ensure that customer information is up-to-date and accurate across all systems. This allows businesses to streamline customer communication, improve collections processes, and enhance overall accounts receivable efficiency.

Streamlined Processes and Improved Efficiency

By leveraging technology integration, businesses can streamline processes, reduce manual errors, and improve overall operational efficiency. This can lead to improved cash flow management, enhanced customer relationships, and increased profitability.

The Future of Accounts Receivable Management: Innovations and Best Practices

The future of accounts receivable management is filled with exciting innovations and best practices that promise to revolutionize the way businesses manage their cash flow and credit risk. One such innovation is the use of blockchain technology for secure and transparent transactions. Blockchain technology has the potential to streamline payment processes, reduce fraud risks, and improve overall accounts receivable security.

Another innovation shaping the future of accounts receivable management is the use of real-time analytics and reporting tools. Real-time analytics allows businesses to gain instant insights into their cash flow performance, customer behavior patterns, and credit risk factors. This enables businesses to make proactive decisions about collection strategies, credit terms, and cash flow management in real time.

In addition to these innovations, best practices such as customer-centric collections strategies are also shaping the future of accounts receivable management. By focusing on building strong customer relationships and understanding individual customer needs, businesses can improve collection effectiveness while maintaining positive customer experiences. In conclusion, commercial credit has a significant impact on accounts receivable management by influencing cash flow timing and amount as well as customer creditworthiness assessment.

Leveraging big data optimizes accounts receivable processes through predictive analytics for cash flow fluctuations anticipation as well as automation for efficiency improvement. Artificial intelligence streamlines accounts receivable by automating invoice processing as well as predictive analytics for decision-making based on customer profiles. Data science improves accounts receivable performance through advanced analytics for optimized collection strategies as well as anomaly detection for fraud prevention.

Applied analytics enhances accounts receivable management by segmenting customers based on payment behavior as well as performance measurement for process optimization. Integrating technology enhances cash flow through automated invoicing as well as seamless data exchange for improved efficiency while innovations like blockchain technology promise secure transactions in the future of accounts receivable management alongside real-time analytics tools for instant insights into cash flow performance.

FAQs

What is accounts receivable management?

Accounts receivable management refers to the process of overseeing and collecting payments from customers who have purchased goods or services on credit. It involves tracking outstanding invoices, following up with customers for payment, and ensuring that cash flow is optimized.

Why is accounts receivable management important?

Effective accounts receivable management is crucial for maintaining a healthy cash flow and ensuring that a business has the necessary funds to operate and grow. It also helps to minimize the risk of bad debt and late payments, ultimately improving the financial health of the business.

What are some best practices for accounts receivable management?

Some best practices for accounts receivable management include establishing clear credit policies, sending out invoices promptly, following up with customers on overdue payments, and implementing automated systems for tracking and managing receivables.

What are the future trends in accounts receivable management?

The future of accounts receivable management is likely to involve greater automation and the use of advanced technology, such as artificial intelligence and machine learning, to streamline processes and improve efficiency. Additionally, there may be a shift towards more personalized and customer-centric approaches to collections and payment processing.