In today’s data-driven world, the role of a Chief Financial Officer (CFO) has evolved beyond traditional financial management. CFOs are now expected to be strategic partners who can drive business growth and make informed decisions based on data. Data-driven decision making has become a critical skill for CFOs, as it allows them to gain insights into their business operations, anticipate future trends and challenges, and drive profitable growth.

Using data to drive business decisions is essential for CFOs because it provides them with a comprehensive understanding of their organization’s performance and helps them identify areas for improvement. By analyzing data, CFOs can uncover trends and patterns that may not be immediately apparent, allowing them to make informed decisions that can positively impact the bottom line. Data-driven decision making also enables CFOs to identify new revenue streams, optimize costs, and improve operational efficiency.

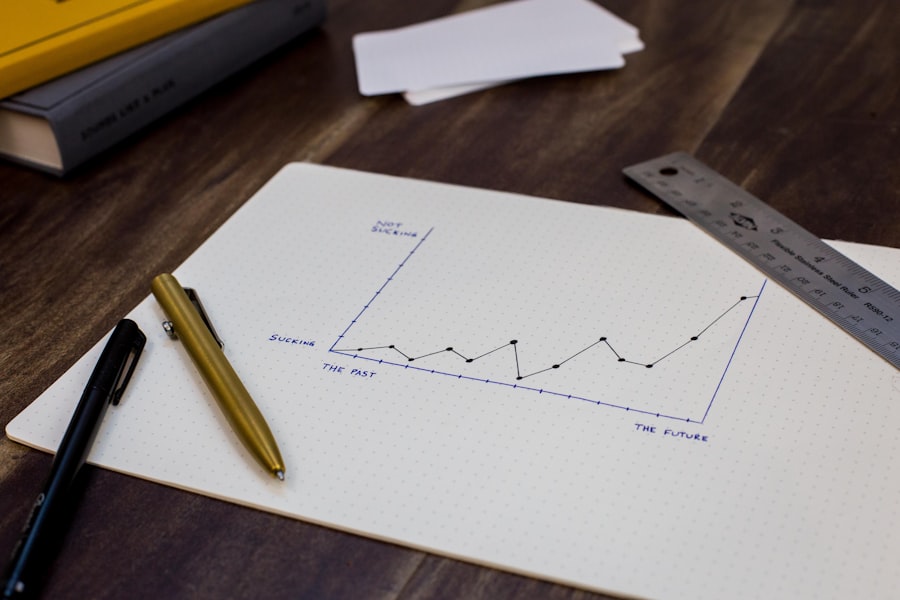

Success stories that showcase the power of data-driven decision making are invaluable for CFOs. These stories not only inspire and motivate CFOs to embrace data-driven decision making but also serve as examples of how data can be effectively used to drive business success. By sharing success stories within their organizations, CFOs can encourage their teams to adopt a data-driven mindset and empower them to make informed decisions based on data.

Key Takeaways

- Data-driven success stories can greatly benefit CFOs

- Descriptive analytics helps understand business through data

- Predictive analytics anticipates future trends and challenges

- Effective data management is crucial for collecting, storing, and analyzing data

- Data integrity ensures accuracy and reliability for profitable growth

Descriptive Analytics: Understanding Your Business Through Data

Descriptive analytics is the first step in the data analysis process and involves understanding historical data to gain insights into past performance and trends. It focuses on answering questions such as “What happened?” and “Why did it happen?” Descriptive analytics allows CFOs to understand their business operations by analyzing large volumes of data and identifying patterns, trends, and correlations.

For example, a CFO can use descriptive analytics to analyze sales data over a specific period to identify which products or services are performing well and which ones are underperforming. By understanding these trends, the CFO can make informed decisions about inventory management, pricing strategies, and marketing campaigns.

Descriptive analytics can also be used to analyze financial data to identify cost-saving opportunities. By analyzing expenses across different departments, a CFO can identify areas where costs can be reduced or eliminated. This can lead to significant savings for the organization and improve its overall financial performance.

CFOs can leverage descriptive analytics to make informed decisions about their business by regularly analyzing and monitoring key performance indicators (KPIs). By tracking KPIs such as revenue growth, profit margins, and customer satisfaction, CFOs can identify areas of improvement and take proactive measures to address any issues.

Predictive Analytics: Using Data to Anticipate Future Trends and Challenges

Predictive analytics takes data analysis a step further by using historical data to forecast future trends and challenges. It focuses on answering questions such as “What is likely to happen?” and “What are the potential outcomes?” Predictive analytics enables CFOs to anticipate future scenarios and make proactive decisions to mitigate risks and capitalize on opportunities.

For example, a CFO can use predictive analytics to forecast sales for the upcoming quarter based on historical sales data, market trends, and other relevant factors. By understanding the potential demand for their products or services, the CFO can make informed decisions about production levels, inventory management, and resource allocation.

Predictive analytics can also be used to forecast other business metrics such as customer churn, cash flow, and employee turnover. By identifying potential challenges in advance, CFOs can develop strategies to address these issues and minimize their impact on the organization.

CFOs can leverage predictive analytics to make proactive decisions about their business by regularly analyzing and monitoring leading indicators. Leading indicators are early warning signs that can help CFOs anticipate future trends and challenges. By tracking leading indicators such as customer satisfaction scores, website traffic, and social media sentiment, CFOs can identify potential issues before they become significant problems.

Data Management: How to Effectively Collect, Store, and Analyze Data

Data management is the process of collecting, storing, and analyzing data to ensure its accuracy, reliability, and accessibility. Effective data management is crucial for CFOs as it enables them to make informed decisions based on reliable and trustworthy data.

To collect data effectively, CFOs need to define clear objectives and identify the key metrics that will help them measure their progress towards these objectives. They also need to ensure that the data they collect is accurate, complete, and relevant to their business goals.

Once data is collected, CFOs need to store it in a secure and accessible manner. This involves implementing robust data storage systems and ensuring that data is backed up regularly to prevent loss or corruption. CFOs should also consider implementing data governance policies to ensure that data is used responsibly and in compliance with relevant regulations.

Analyzing data effectively requires CFOs to have the right tools and technologies in place. This may involve investing in data analytics software or partnering with external vendors who can provide advanced analytics capabilities. CFOs should also ensure that their teams have the necessary skills and training to analyze data effectively.

Data Integrity: Ensuring the Accuracy and Reliability of Your Data

Data integrity refers to the accuracy, reliability, and consistency of data. It is essential for CFOs to ensure that their data is trustworthy and reliable as it forms the foundation for their decision-making process.

To ensure data integrity, CFOs should implement robust data validation processes. This involves verifying the accuracy of data by comparing it against known sources or conducting manual checks. CFOs should also implement data quality controls to identify and correct any errors or inconsistencies in the data.

CFOs should also establish clear data governance policies to ensure that data is used responsibly and in compliance with relevant regulations. This may involve implementing access controls to restrict who can access and modify data, as well as implementing data privacy measures to protect sensitive information.

Regular data audits are also essential to ensure data integrity. CFOs should regularly review their data management processes and systems to identify any potential issues or areas for improvement. This can help CFOs identify and address any data integrity issues before they impact their decision-making process.

Profitable Growth: Using Data to Drive Revenue and Improve Your Bottom Line

Data-driven decision making is a powerful tool for driving profitable growth. By leveraging data, CFOs can identify new revenue streams, optimize costs, and improve their organization’s bottom line.

For example, a CFO can use data to identify customer segments that have the highest profit margins and focus their marketing efforts on these segments. By understanding the needs and preferences of these customers, the CFO can develop targeted marketing campaigns that are more likely to generate sales and increase revenue.

Data can also be used to optimize costs and improve operational efficiency. By analyzing data on expenses, CFOs can identify areas where costs can be reduced or eliminated. This may involve renegotiating contracts with suppliers, streamlining processes, or implementing cost-saving initiatives.

Furthermore, data-driven decision making can help CFOs identify opportunities for business expansion or diversification. By analyzing market trends and customer preferences, CFOs can identify new products or services that align with their organization’s capabilities and target market. This can help drive revenue growth and improve the organization’s overall financial performance.

Case Study I: How a Retail Company Used Descriptive Analytics to Boost Sales

One real-world example of a company that used descriptive analytics to boost sales is a retail company that wanted to understand why certain products were selling better than others. The company collected sales data from its stores and analyzed it using descriptive analytics techniques.

By analyzing the sales data, the company was able to identify trends and patterns that were not immediately apparent. They discovered that certain products were selling better in specific regions or during certain seasons. Armed with this information, the company was able to make informed decisions about inventory management, pricing strategies, and marketing campaigns.

For example, the company used the insights gained from the data analysis to adjust its inventory levels to meet customer demand. They also developed targeted marketing campaigns that highlighted the products that were selling well in specific regions or during certain seasons. As a result, the company saw a significant increase in sales and improved its overall financial performance.

Case Study II: How a Healthcare Organization Used Predictive Analytics to Improve Patient Outcomes

Another real-world example of a company that used predictive analytics to drive business success is a healthcare organization that wanted to improve patient outcomes. The organization collected data on patient demographics, medical history, and treatment outcomes and analyzed it using predictive analytics techniques.

By analyzing the data, the organization was able to identify patterns and correlations between patient characteristics and treatment outcomes. They developed predictive models that could forecast the likelihood of different treatment outcomes based on patient demographics and medical history.

Using these predictive models, the organization was able to make proactive decisions about patient care. For example, they could identify patients who were at high risk of complications and provide them with additional support or interventions. This led to improved patient outcomes and reduced healthcare costs for the organization.

Case Study III: How a Manufacturing Company Improved Data Management to Streamline Operations

A real-world example of a company that improved data management to streamline operations is a manufacturing company that was experiencing inefficiencies in its production process. The company collected data on production times, equipment downtime, and quality control issues and analyzed it using data management techniques.

By analyzing the data, the company was able to identify bottlenecks in its production process and areas where efficiency could be improved. They also discovered that equipment downtime was a significant contributor to production delays and quality control issues.

To address these issues, the company implemented a robust data management system that allowed them to track equipment performance in real-time. They also implemented preventive maintenance measures to reduce equipment downtime and improve overall production efficiency.

As a result of these data-driven decisions, the company was able to streamline its operations, reduce production delays, and improve product quality. This led to significant cost savings and improved customer satisfaction.

The Importance of Data-driven Decision Making for CFOs

In conclusion, data-driven decision making is essential for CFOs as it allows them to gain insights into their business operations, anticipate future trends and challenges, and drive profitable growth. Descriptive analytics helps CFOs understand their business by analyzing historical data and identifying trends and patterns. Predictive analytics enables CFOs to anticipate future scenarios and make proactive decisions. Effective data management and data integrity are crucial for ensuring the accuracy and reliability of data. By leveraging data, CFOs can drive revenue growth, improve their bottom line, and make informed decisions that positively impact their organization.

CFOs should embrace data-driven decision making and use success stories to inspire their teams. By sharing success stories within their organizations, CFOs can encourage their teams to adopt a data-driven mindset and empower them to make informed decisions based on data. Data-driven decision making is no longer a luxury but a necessity for CFOs who want to stay ahead in today’s competitive business landscape.

If you’re a CFO looking for inspiration on how data-driven strategies can lead to success, look no further than this article on B2B Analytic Insights. This insightful piece highlights real-world examples of companies that have leveraged data to drive their financial performance. From optimizing pricing strategies to improving supply chain efficiency, these success stories demonstrate the power of data analytics in making informed business decisions. To read more about these inspiring examples, visit B2B Analytic Insights’ blog at https://b2banalyticinsights.com/blog/.